Investor Relations Terms and Conditions

By clicking “Accept” below, you are deemed to represent that you are, or are accessing this information on behalf of, (i) an institutional investor that is an accredited investor within the meaning of Rule 501(a) under the Securities Act of 1933 (the “Act”) or (ii) a qualified institutional buyer within the meaning of Rule 144A under the Act.

This website and any information or documents for which we provide hyperlinks do not constitute an offer of any securities for sale. The materials on this website and any information provided by means of hyperlinks are furnished for informational purposes only. Moreover, you should assume that any dated information is accurate only as of the date indicated and will not be updated.

Sales & Trading

Since 2003, the Sales & Trading team has been working directly with institutional investors to provide fixed income solutions, real-time execution, and insight into Toyota. The team of fixed income investment professionals strives to deliver solutions to fit clients′ investment objectives and risk tolerance.

The Sales & Trading team's comprehensive approach has allowed it to have success with a large investor base which includes asset managers, corporate treasurers, financial institutions, foundations and endowments, pension and retirement funds, and state and local municipalities.

Products Offered

The Sales & Trading team provides fixed income products to meet the unique investment objectives and risk tolerances of institutional investor clients.

Commercial Paper

Toyota Motor Credit Corporation (TMCC), Toyota Credit de Puerto Rico Corp. (TCPR), Toyota Credit Canada Inc. (TCCI), Toyota Finance Australia Limited (TFA), and Toyota Motor Finance (Netherlands) B.V. (TMFNL) issue commercial paper to meet short-term funding needs. The commercial paper programs hold the highest short-term credit ratings,1 A-1+/P-1/F1 by S&P, Moody's, and Fitch, respectively. Each of TMCC, TCPR, TCCI, TFA, and TMFNL has entered into credit support agreements with Toyota Financial Services Corporation TFSC, and TFSC has in turn entered into a credit support agreement with Toyota Motor Corporation.

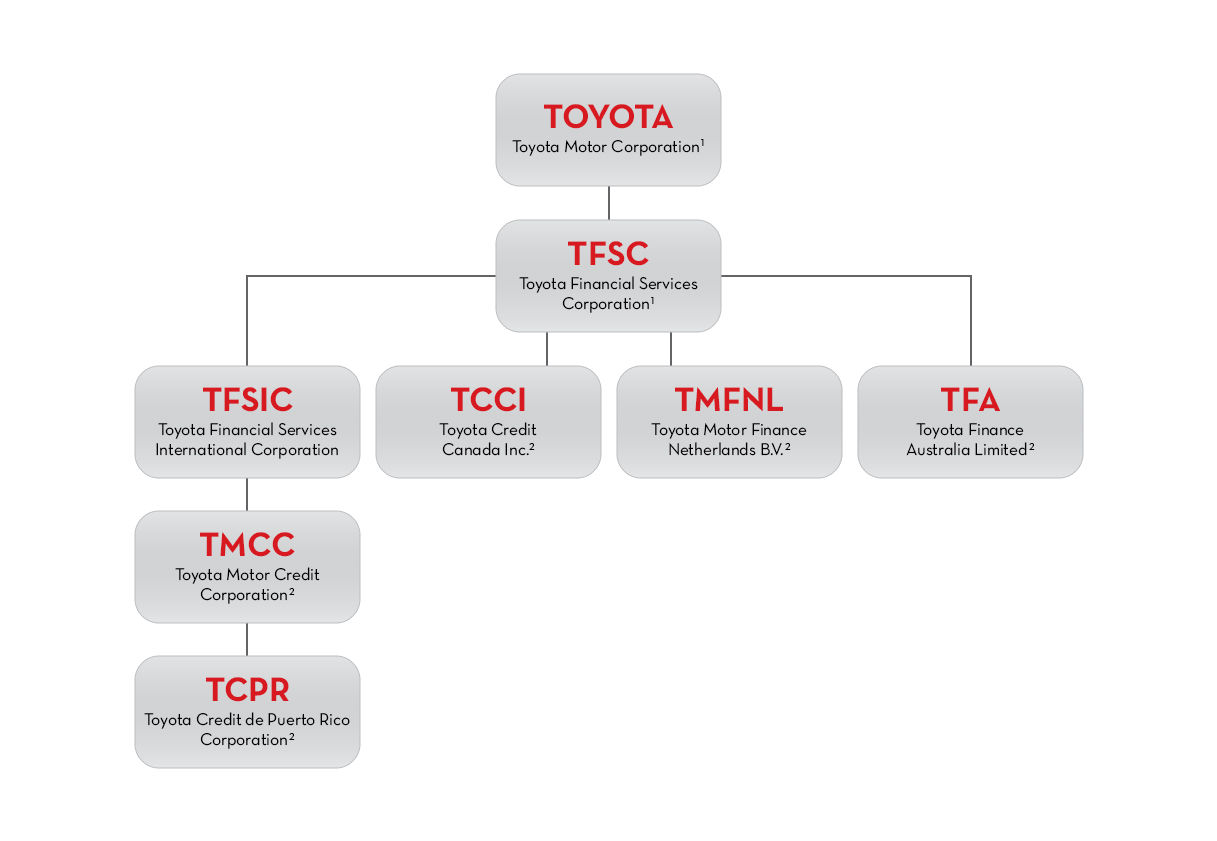

View the organizational structure of these entities and their associated credit support agreements.

IncomeDriver NotesTM

IncomeDriver NotesTM offer an opportunity to invest with a company you know and trust. Offering a variable rate of interest, simple access to funds, and no long-term commitment, IncomeDriver NotesTM are a great way to begin investing with a trusted partner like TMCC. Learn more

TMCC has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents TMCC has filed with the SEC for more complete information about TMCC and this offering. You may get these documents for free by visiting the SEC website at SEC.gov | Home or by downloading them here. Alternatively, TMCC will arrange to send you the prospectus if you request it by calling 1-844-464-4673.

1. Current ratings are as of May 27, 2020.

Organizational Structure

Toyota Motor Corporation

Toyota Motor Corporation markets vehicles in over 200 countries and regions and conducts its business worldwide with more than 50 overseas manufacturing organizations in 26 countries and regions besides Japan. TMC is a provider of credit support to Toyota Financial Services Corporation TFSC. Click here to view the agreement.

Toyota Financial Services Corporation

TFSC, a Japanese corporation, is a wholly-owned subsidiary of Toyota Motor Corporation (TMC), a Japanese corporation. TFSC manages TMC’s worldwide financial services operations. TFSC is a provider of credit support to Toyota Motor Credit Corporation (TMCC), Toyota Credit de Puerto Rico Corp. (TCPR), Toyota Credit Canada Inc. (TCCI), Toyota Finance Australia Limited (TFA) and Toyota Motor Finance (Netherlands) B.V. (TMFNL). For more information regarding these credit support agreements, please view the links provided in the sections below.

Toyota Motor Credit Corporation

TMCC is wholly-owned by Toyota Financial Services International Corporation (TFSIC), a California corporation, which is a wholly-owned subsidiary of TFSC. TMCC is marketed under the brands of Toyota Financial Services, Lexus Financial Services, Mazda Financial Services, and Bass Pro Shops Financial Services. TMCC provides a variety of finance and voluntary vehicle and payment protection products and services to authorized Toyota and Lexus dealers or dealer groups, private label dealers or dealer groups, and to a lesser extent, other domestic and import franchise dealers and their customers in the United States (U.S.) and Puerto Rico. TMCC acquires retail installment sales contracts from dealers in the U.S. and Puerto Rico and leasing contracts accounted for as operating leases from vehicle dealers in the U.S. TMCC also provides dealer financing, including wholesale financing, working capital loans, revolving lines of credit and real estate financing to dealers in the U.S. and Puerto Rico. Click here to view the TFSC - TMCC credit support agreement.

Toyota Credit de Puerto Rico Corp.

TCPR is incorporated in Puerto Rico and is a wholly-owned subsidiary of TMCC. TCPR provides retail and wholesale financing and certain other financial services to authorized Toyota, Lexus, their customers, and affiliated companies specifically in the Commonwealth of Puerto Rico. Click here to view the TFSC-TCPR credit support agreement.

Toyota Credit Canada Inc.

TCCI is a wholly-owned subsidiary of TFSC. The principal business of TCCI is to provide financing services for authorized Canadian Toyota dealers and users of Toyota products. Financial products offered by TCCI (i) to customers, include lease and loan financing; and (ii) to Toyota dealers, include floor plan financing, wholesale lease financing and dealership financing. Such financing programs are offered in all provinces and territories of Canada. In addition to TCCI’s principal business of providing finance products to authorized Toyota and Lexus dealers and their customers in Canada, TCCI also provides finance products to authorized Subaru dealers and their customers pursuant to an arrangement that TCCI has entered into with Subaru Canada, Inc. Click here to view the TFSC - TCCI credit support agreement.

Toyota Finance Australia Limited

TFA, which was incorporated as a public company limited by shares in New South Wales, Australia on 18 June 1982, operates under the Australian Corporations Act and is a wholly-owned subsidiary of TFSC. The principal activities of TFA, which are an integral part of the Toyota group's presence in Australia, are:

- Financing the acqusition of motor vehicles by customers by way of commercial leases and consumer and commercial loans,

- Providing bailment facilities and commercial loans to motor dealers,

- Providing vehicle finance (by way of loans, term purchase, finance lease or operating lease) and fleet management services to corporate customers and government bodies,

- Selling retail insurance policies underwritten by third party insurers as agents, and

- To provide for car sharing services.

Click here to view the TFSC - TFA credit support agreement.

Toyota Motor Finance (Netherlands) B.V.

TMFNL, which was incorporated as a private company with limited liability, under Netherlands laws on 3 August 1987 is a wholly-owned subsidiary of TFSC. The principal business of TMFNL is to act as a group finance company for some of TMC's consolidated subsidiaries. TMFNL raises funds by issuing bonds and notes in the international capital markets and from other sources and on-lends to other Toyota companies. TMFNL also provides committed facilities to certain other Toyota companies and guarantees for debt issuances of certain other Toyota companies. In addition, TMFNL generates income from other investments and deposits incidental to its primary funding activities. As a group finance company, TMFNL is dependent on the performance of the subsidiaries and affiliates of TMC and TFSC to which it grants loans and in respect of which it provides guarantees. Click here to view the TFSC - TMFNL credit support agreement.

-

Credit support providers

-

Commercial paper issuing entities